Introduction: since the global outbreak and spread of the epidemic in 2020, the global economy has been traumatized. Investment institutions have significantly reduced the amount and scale of investment and reduced the expected growth. China has handled the epidemic properly, the economy has recovered steadily, and the three child policy will be fully opened in 2021. What changes have taken place in the investment and financing of the domestic maternal and infant industry? What areas are investors concerned about and what areas are not valued? The maternal and Infant Research Institute, the industrial analysis platform of maternal and infant industry observation, released the investment and financing report of maternal and infant industry in the first three quarters of 2021 (hereinafter referred to as the report), which interprets the focus of capital on maternal and infant industry and new opportunities from multiple dimensions.

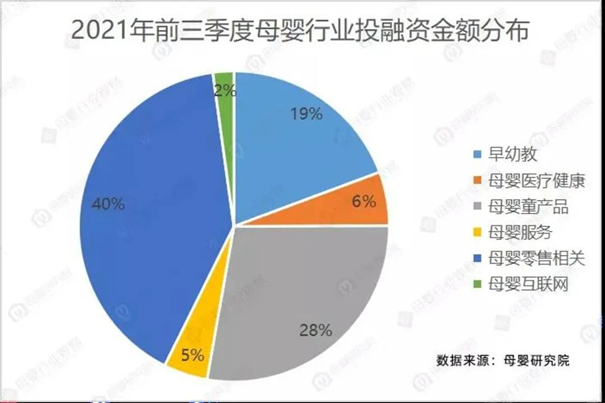

According to statistics, in the first three quarters of 2021, there were 64 investment and financing events in the maternal and infant industry, and the total financing amount of the disclosed projects reached RMB 11.618 billion. 40% of the important targets were mainly related to maternal and infant retail, and 28% were related to maternal and infant products.

Compared with the past, the overall investment amount in the maternal and infant industry decreased significantly in 2021. Compared with last year, although the number of overall investment institutions and users decreased, the total amount of investment and financing increased. The increase in the total amount is mainly due to the recognition of the relevant head projects of the leading enterprises by investors, good market prospects, prominent and intensified agglomeration effect, and a large amount of capital overweight of valuable excellent projects.

Let's take a look at the performance of each sub circuit in the maternal and infant industry, as well as the opportunities and change direction for the future.

The new consumer capital fever has cooled down, and the zero supplementary food track attracts the most gold

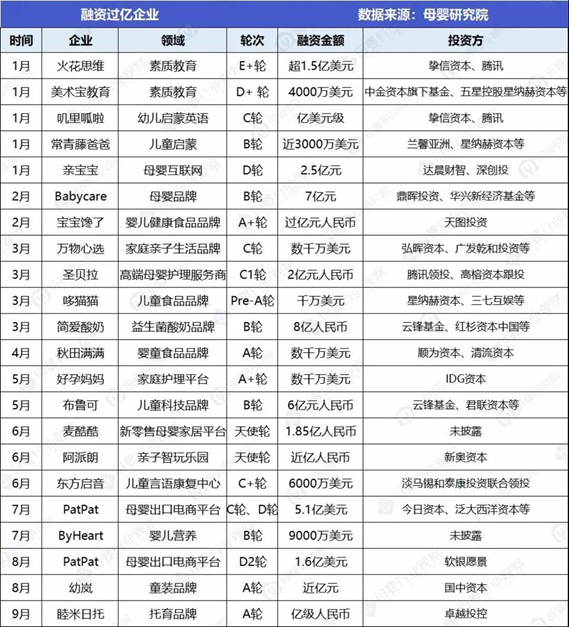

According to the data of maternal and Infant Research Institute, there were 24 investment and financing in the field of maternal, infant and child products in the first three quarters of 2021, including 13 financing in infant food, especially infant zero complementary food, with a financing amount of 1.5 billion yuan.

For a long time, the infant snack industry has been dominated by international brands such as Garbo and Heinz. With the gradual improvement of young parents' acceptance of domestic products, China's snack brands are being seen by the capital and market.

In addition, the large amount of financing in the field of mother, baby and children's products was also given to BabyCare, Jane Eyre yogurt, Brock and Youlan respectively. A closer look shows that these brands are all dark horse brands running out of the new consumption track without exception.

New consumption once became an area of great concern to capital. Of course, a large part of the reason was that other investment channels were blocked, so they poured into the field of consumer goods that seemed to have a very stable growth.

But this year there is an obvious trend, & ldquo; Capital seems unable to invest in new consumption & rdquo;, Only from our existing statistical data, the number of new consumer brands invested is not only decreasing, but also the amount of money obtained is decreasing year by year. There are two reasons. First, in most tracks of new consumption, the head has quietly formed and is more than two positions ahead of the second place, so it is difficult for new brands to get out; Second, it is more and more difficult to find new growth opportunities for tracks and categories. When small groups are surrounded by capital, there are fewer and fewer opportunities for new brands. Overall, the consumer market is still hot, but the capital is becoming more and more calm.

Maternal and infant retail supported large amount of financing, and only pat was invested 4 billion+

According to the analysis of investment and financing data collected by the Institute of maternal and infant research, there were four investment and financing events related to maternal and infant retail in the first half of 2021, with a total financing amount of 4.663 billion, which also confirms that capital is moving closer to unicorn.

From the perspective of investment preference, on the one hand, capital accelerates the pursuit of new retail for mothers and infants. Taking the new retail brand makuku McCool for mothers and infants as an example, it is also the main concept of DTC, and constructs a business model with member operation as the core through the constructed offline channels. In addition, Baoma operates a community experience store with its own contacts and traffic to transform private traffic. Less than a year after its establishment, it obtained the angel round financing led by ATM capital and followed by Aoyou dairy and Taihe capital, with a financing amount of RMB 185 million, setting the largest first round financing record of China's new mother and baby brand.

The withdrawal of double reduction landing capital and the sudden cooling of investment in early childhood education industry

“ Double subtraction & rdquo; The official landing and implementation of the document has brought great changes to the education industry. The once popular capital of education stocks is far away from it.

Compared with the past few years, the whole early childhood education industry has ushered in a major turning point this year. With the fall of the hammer of the double reduction policy, the attitude of most investment institutions towards the early childhood education industry has become colder and even exited one after another.

Maternal and infant family health is highly concerned, and there are many new water testers in the field of maternal and infant services

In the first three quarters of 2021, there were 7 investment and financing in the field of maternal and infant health care, including two relatively large amounts of financing. First, taking maternal and infant care services as the incision, the business has gradually expanded to good pregnant mothers in the upstream and downstream fields of the family life service industry. Second, it provides international standard speech therapy, behavior intervention Oriental Kai Yin of functional / occupational therapy and integrated education services.

Capital also sees new opportunities for mother and child services. In the investment and financing of mother and child services, the number of financing events in the early stage (angel round and round a) still accounts for the majority, up to 9, accounting for a large enough proportion, and most of them are in the amount of millions. With the further refinement of consumption upgrading, the demand for mother and child services is becoming more and more obvious and released. Although we see great opportunities for capital, we are still more cautious.

After watching the performance of the primary market, let's review the IPO data of mother and child enterprises in 2021 and the performance of listed companies.

Listed companies are also accelerating their buying, and the child king's bell ringing has become a landmark event in the industry

According to the report of Anxin securities, there are 360 listed companies in 2021, which is also lively in the field of mothers and infants. First, the upstream dairy enterprises accelerated their IPO. For example, Youran dairy successfully landed in the capital market, the regional dairy enterprises Jiangxi Sunshine Dairy Co., Ltd. broke through the IPO, Huahua cattle and knight dairy also entered the stage of listing guidance and filing, and Junhua agriculture and animal husbandry also applied for filing and entered the selection layer last year... Industry insiders believe that there are two main reasons for dairy enterprises to get listed: first, during the epidemic period, Compared with the non listed dairy enterprises, the listed dairy enterprises have obviously insufficient ability to resist risks; Second, listing has a positive effect on improving the competitiveness of dairy enterprises, especially regional dairy enterprises in the post epidemic era.

At the same time, the process of acquisition and M & A of dairy giants is also accelerating. For example, Feihe acquired all the shares of Xiaoyang Miaoke. Some time ago, Aoyou's short suspension was interpreted as related to Yili's stake. In addition, it is worth mentioning that Chunhua capital acquired the business of Mead Johnson, an infant nutrition company of Lijie, in Greater China with 14 billion yuan, and will have the permanent exclusive right to use the Mead Johnson brand in the Greater China market. In fact, Chunhua capital has long had a layout in the dairy industry. In 2019, the company took the lead in acquiring the equity of JUNLEBAO dairy industry and became one of its important investors. We don't know whether Mead Johnson can strike a spark with JUNLEBAO in the future, but it is certain that China's milk powder market is ushering in a new round of high concentration.

In addition, a number of nursing products enterprises such as diapers also rang the bell to go public. For example, on May 18, 2021, Yiyi Co., Ltd., a pet hygiene products manufacturer with a market value of 6.1 billion by selling pet diapers, officially landed on the main board of Shenzhen Stock Exchange; June 17, 2021, & ldquo; The first strand of Adult Diapers & rdquo; Reliable shares are listed on the A-share market. Its strong development momentum not only confirms the leading position of reliable care in the industry, but also enhances the development confidence of the whole sanitary products industry. In addition, diaper raw material suppliers such as polyglue shares are also sprinting for IPO.

Focusing on the field of mother and baby retail, on October 14, child king was successfully listed on the main board a shares, which soared by more than 300% on the first day of opening, with a maximum market value of more than 25 billion. It has also become the new king of the market value of China's mother and baby brand A shares. Its listing is a hot event in the industry, which not only boosted the external confidence in the mother and baby market to a certain extent, but also stimulated the ambitions and ideals of more practitioners. According to the prospectus at that time, the number of shares issued by child king did not exceed about 109 million shares, raised about 2.449 billion yuan, and 60% of the funds were used to continue to expand stores. Undeniable, childrenWang will continue to expand its territory and seize more offline market share with its comprehensive strength and strong capital strength after listing. As for the listed baby friendly room, its performance in the capital market is also noteworthy. Baby friendly room acquired 100% equity of Beibei bear for 200 million yuan, and wants to quickly enter central China through M & A. It can be predicted that baby friendly room can also expand the overall scale of the listed company through this acquisition and further improve the company's purchasing bargaining power with upstream suppliers, So as to continuously consolidate the company's industry position.

On the whole, with the implementation of the policy, the market environment is constantly changing, and the players on the track are constantly shuffling and changing. Investors are treated more rationally and have more patience. Capital is rapidly returning to the wrong track of value investment rather than following the trend of speculation. As relevant employees of the industry, we can only hope that the future mother and baby industry can walk out of a new road and develop better.

Comment(0)

You can comment after

SIGN IN