Adhesives are also known as adhesives or adhesives, or & ldquo; Glue & rdquo;. Adhesive & ldquo; can be found in various fields such as construction, packaging, aerospace, aviation, electronics, automobile, mechanical equipment, medical and health care, light textile and so on; Figure & rdquo;. In terms of capital market, poly glue new materials Co., Ltd., which is mainly engaged in hot melt adhesive products of sanitary materials (hereinafter referred to as "poly glue Co., Ltd."), & ldquo; Line up for admission & rdquo;.

From the perspective of industry, poly glue Co., Ltd. is a provider of hot-melt glue for sanitary materials. From 2016 to 2020, the year-on-year growth rate of domestic hot-melt adhesive production and sales volume showed a downward trend. From 2016 to 2019, the growth rate of market scale in the field with the largest consumption of polymer joint-stock products also declined as a whole. In this context, the net profit of poly rubber shares increased negatively for two consecutive years, and the return on net assets decreased year by year. In addition, it is worth noting that the historical expansion project of poly Rubber Co., Ltd. may have been & ldquo; Cast before inspection & rdquo;, The production capacity involved is over 10000 tons, which is regrettable.

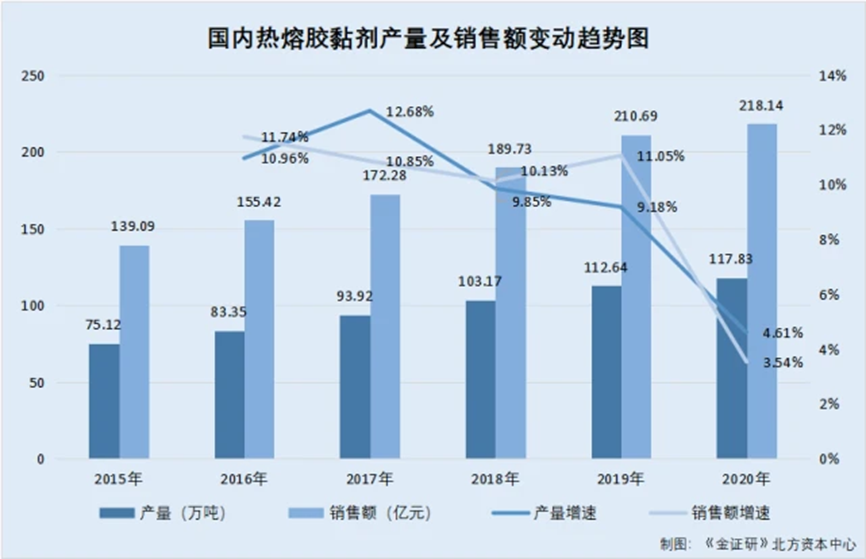

The prosperity of the industry affects the development of relevant enterprises. As the main business of the melt adhesive industry, the output of the melt adhesive industry showed a year-on-year growth trend in 2016-2020.

It should be noted that during the reporting period, i.e. 2019-2021, the main business income of poly glue Co., Ltd. came from sanitary materials hot melt adhesive products.

According to the prospectus signed on March 28, 2022 (hereinafter referred to as the "prospectus"), Poly glue Co., Ltd. is a company specialized in R & D and production of hot melt adhesive for absorbent sanitary products (hereinafter referred to as & ldquo; hot melt adhesive for sanitary materials & rdquo;) As the core supplier of business, it focuses on the R & D, production and sales of hot-melt adhesive for sanitary materials. Sanitary material hot melt adhesive is a kind of adhesive based on thermoplastic polymer, which can be quickly bonded by coating in molten state, wetting the adherend, cooling and hardening, and applying light pressure.

According to the prospectus, the hot-melt adhesive products of sanitary materials of poly Rubber Co., Ltd. mainly include structural adhesive, rubber band adhesive, back adhesive and special adhesive. From 2019 to 2021, the main business income of poly Rubber Co., Ltd. is divided into structural rubber, rubber band rubber, back rubber and special rubber by product category.

According to the prospectus, from 2019 to 2021, the main business income of poly rubber shares accounted for more than 99% of the operating income, which is the main source of income of poly rubber shares. Other business income in the operating income is mainly the sales income of waste packaging materials of poly Rubber Co., Ltd.

In other words, the operating income of poly glue shares exceeds 90%, which becomes the income of hot-melt adhesive products of sanitary materials.

However, from 2016 to 2020, the growth rate of domestic hot melt adhesive production and sales showed a downward trend as a whole.

According to the prospectus, hot melt adhesive is a kind of polymer adhesive which is coated in hot melt state and bonded by cooling and hardening. Hot melt adhesive does not use any solvent in production and application. It is non-toxic, tasteless, does not pollute the environment and has & ldquo; Green adhesive & rdquo; It is especially suitable for continuous, automatic and high-speed production lines. Hot melt adhesive is mainly composed of thermoplastic polymers. Within a certain temperature range, its physical state changes with temperature, while its chemical properties remain unchanged.

According to Jiangsu Jiahao hot melt adhesive Co., Ltd. (hereinafter referred to as & ldquo; Jiahao & rdquo;) Prospectus signed on December 21, 2021 (hereinafter referred to as "Jiahao share prospectus") According to the data from China adhesive and adhesive tape industry association, from 2015 to 2020, the output of domestic hot-melt adhesive was 751200 tons, 833500 tons, 939200 tons, 1031700 tons, 1126400 tons and 1178300 tons respectively. In the same period, the sales of domestic hot-melt adhesives were 13.909 billion yuan, 15.542 billion yuan, 17.228 billion yuan, 18.973 billion yuan, 21.069 billion yuan and 21.814 billion yuan respectively.

According to the calculation of the northern capital center of jinzhengyan, from 2016 to 2020, the year-on-year growth rates of domestic hot-melt adhesive production were 10.96%, 12.68%, 9.85%, 9.18% and 4.61% respectively. Over the same period, the year-on-year growth rates of domestic hot-melt adhesive sales were 11.74%, 10.85%, 10.13%, 11.05% and 3.54% respectively.

It is not difficult to see that from 2016 to 2020, the year-on-year growth rate of domestic hot-melt adhesive production and sales showed a downward trend as a whole.

In addition, the growth rate of market scale in the field with the largest consumption of poly rubber products also showed a downward trend as a whole.

According to the prospectus, the hot-melt adhesive products of sanitary materials of poly glue Co., Ltd. mainly include structural adhesive, rubber band adhesive, back adhesive and special adhesive, which are widely used in the fields of baby diapers / tablets, women's sanitary napkins / pads, adult incontinence products, pet pads, medical mattresses, protective clothing and so on. Among them, diapers and sanitary napkins are the areas with the largest consumption of poly rubber products.

According to the prospectus of Jiahao shares quoted from the Yearbook of Chinese household paper, domestic absorbent sanitary products include female sanitary products, baby diapers / tablets and adult incontinence products. From 2015 to 2019, the market scale of domestic female sanitary products was 39.8 billion yuan, 50.8 billion yuan, 52.7 billion yuan, 56.3 billion yuan and 57.2 billion yuan respectively. In the same period, the market scale of domestic baby diapers / tablets was 35.2 billion yuan, 48.1 billion yuan, 54.9 billion yuan, 49.7 billion yuan and 49.9 billion yuan respectively, and the market scale of domestic adult incontinence products was 5.1 billion yuan, 4.9 billion yuan, 6.3 billion yuan, 7 billion yuan and 9.4 billion yuan respectively.

According to the calculation of the northern capital center of jinzhengyan, from 2015 to 2019, the market scale of domestic absorbent sanitary products was 80.1 billion yuan, 103.8 billion yuan, 113.9 billion yuan, 113 billion yuan and 116.5 billion yuan respectively. From 2016 to 2019, the year-on-year growth rates of domestic absorbent sanitary products market were 29.59%, 9.73%, - 0.79% and 3.1% respectively.

That is to say, from 2016 to 2019, the overall growth rate of domestic absorbent sanitary products market showed a downward trend, and in 2018, the domestic absorbent sanitary products market showed negative growth.

It is worth noting that during the reporting period, the net profit of poly rubber shares increased negatively for two consecutive years.

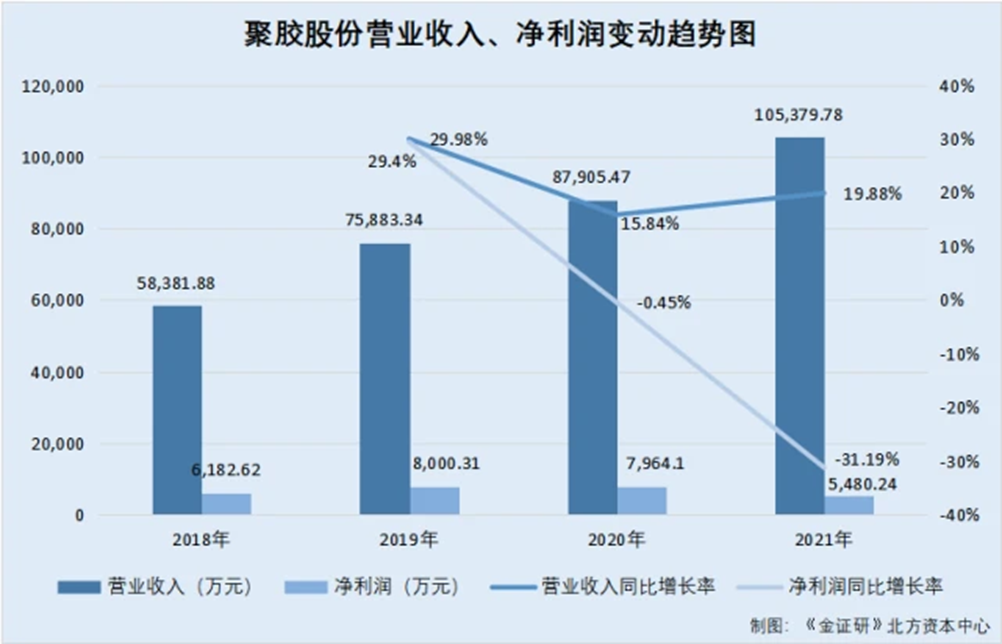

According to the prospectus signed by polyglue on February 27, 2022 (hereinafter referred to as "February prospectus"), In 2018, the operating revenue of poly Rubber Co., Ltd. was 584 million yuan. In the same period, the net profit of poly Rubber Co., Ltd. was 61.8262 million yuan.

According to the prospectus, from 2019 to 2021, the operating revenue of poly rubber shares was 759 million yuan, 879 million yuan and 1054 million yuan respectively. In the same period, the net profits of poly rubber shares were 80.032 million yuan, 79.6406 million yuan and 54.8024 million yuan respectively.

From 2019 to 2021, the year-on-year growth rates of operating revenue of poly rubber shares were 29.98%, 15.84% and 19.88% respectively. In the same period, the year-on-year growth rates of net profit of poly rubber shares were 29.4%, - 0.45% and - 31.19% respectively.

It can be seen that from 2020 to 2021, while the revenue scale of poly rubber shares continued to grow, the net profit increased negatively for two consecutive years.

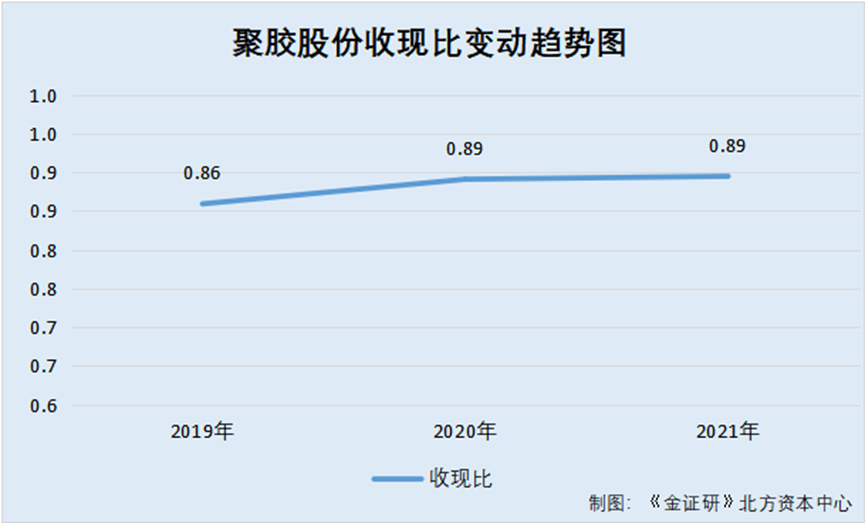

In addition, during the reporting period, the cash to cash ratio of poly rubber shares was less than 1, and its net cash flow from operating activities in 2021 was negative.

According to the prospectus, from 2019 to 2021, the subtotal of cash inflow from operating activities of poly rubber shares was 652 million yuan, 783 million yuan and 943 million yuan respectively. In the same period, the net cash flow from the operating activities of poly Rubber Co., Ltd. was 49.8289 million yuan, 101.6396 million yuan and -8.4073 million yuan respectively.

According to the calculation of jinzhengyan northern capital center, from 2019 to 2021, the cash to cash ratios of poly rubber shares were 0.86, 0.89 and 0.89 respectively.

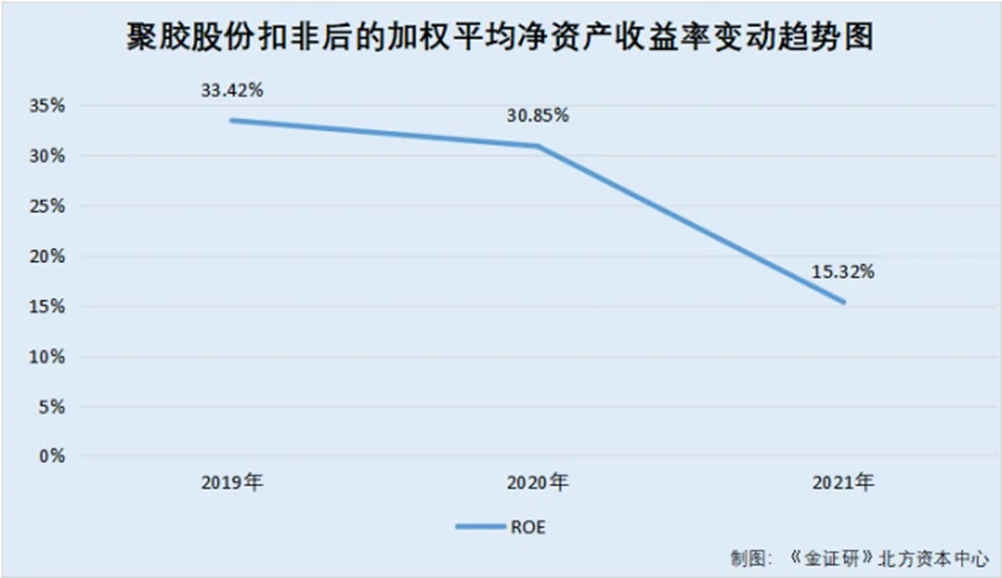

It should be noted that during the reporting period, the weighted average return on net assets of poly rubber shares after deducting non recurring profits and losses decreased year by year.

According to the prospectus, from 2019 to 2021, the weighted average return on net assets of polymer shares after deducting non recurring profits and losses were 33.42%, 30.85% and 15.32% respectively.

In addition, compared with 7 comparable companies in the same industry, the number of authorized invention patents of poly Rubber Co., Ltd. & ldquo; Bottom & rdquo;.

According to the prospectus, as of March 28, 2022, the signing date of the prospectus, polyglue shares has obtained three authorized invention patents.

According to the reply to the third round of examination and inquiry letter on the application documents for the initial public offering and listing of poly rubber shares on the gem signed by poly Rubber Co., Ltd. on February 27, 2022, as of the end of June 2021, the comparable companies in the same industry of poly Rubber Co., Ltd., Jiahao Co., Ltd., Shanghai Tianyang hot melt bonding material Co., Ltd., Hubei Huitian New Material Co., Ltd., Chengdu Sibao Technology Co., Ltd Guangzhou Jitai Chemical Co., Ltd. and Beijing GAOMENG new materials Co., Ltd. have obtained 30, 119, 89, 121, 61 and 134 authorized invention patents respectively. By the end of 2020, Kangda Xincai, a comparable company in the same industry of poly Rubber Co., Ltd., had obtained 79 authorized invention patents.

It can be seen from the above that poly glue Co., Ltd. is an enterprise that develops, produces and sells hot-melt adhesive for sanitary materials. However, from 2016 to 2020, the year-on-year growth of domestic hot melt adhesive production and sales generally showed a slowing trend. From 2016 to 2019, the growth rate of market scale in the field with the largest consumption of poly rubber products also declined as a whole. In this case, the number of authorized invention patents of poly Rubber Co., Ltd. is less than that of comparable companies in the same industry. In addition, from 2020 to 2021, the income of poly rubber shares increased without increasing profits, and the net profit is now negative growth. In addition, from 2019 to 2021, the cash to cash ratio of polymer shares was less than 1, and the weighted average return on net assets decreased year by year after deduction. The continued profitability of poly rubber shares may be tortured.

In this listing, poly Rubber Co., Ltd. plans to raise 481 million yuan for Construction & ldquo; Manufacturing and R & D headquarters project of polymer new materials with an annual output of 120000 tons of sanitary products & rdquo& ldquo; Construction project of Polish production base of sanitary materials hot melt adhesive products & rdquo& ldquo; Supplementary working capital projects & rdquo;. Looking back on the past, poly Rubber Co., Ltd. may have & ldquo; Not tested & rdquo;.

According to the prospectus, the scale of poly rubber shares continues to expand. In order to meet the market demand, poly rubber shares continues to expand its production capacity, increasing its production capacity to 80000 tons in 2021, and has built line 5, which is expected to increase its production capacity by 23000 tons.

According to the February prospectus and prospectus, from 2018 to 2021, the main products of poly Rubber Co., Ltd. were structural glue, rubber tendon glue, back glue and special glue. The production processes of various products were similar, the production equipment was the same and the production capacity was shared. In the same period, the total production capacity of poly rubber products was 60000 tons, 66700 tons, 80000 tons and 80000 tons respectively, and the total output was 39600 tons, 53200 tons, 63200 tons and 80000 tons respectively.

Therefore, from 2018 to 2019, the total production capacity of hot melt adhesive products of poly Rubber Co., Ltd. was 60000 tons and 66700 tons respectively, and the total output was 39600 tons and 53200 tons respectively.

“ Strange & rdquo; On the basis that the construction project can be put into operation only after environmental impact assessment and acceptance, the total production capacity of hot melt adhesive products of poly Rubber Co., Ltd. may be 8000 tons by the end of 2018.

According to the public information of Guangzhou green network environmental protection service center, the environmental impact report of the 23000 ton hot melt adhesive expansion project of poly Rubber Co., Ltd. (hereinafter referred to as "environmental assessment report") Prepared in April 2021, & ldquo; Expansion project of 23000 T / a hot melt adhesive of poly Rubber Co., Ltd. & rdquo; The construction unit is poly Rubber Co., Ltd. and the construction site is building A1, No. 20, Lixin Sixth Road, Xiancun Town, Zengcheng County, Guangzhou City, Guangdong Province& ldquo; Expansion project of 23000 T / a hot melt adhesive of poly Rubber Co., Ltd. & rdquo; The total investment is 6.48 million yuan, and the construction period is from August 2021 to September 2021.

In the EIA report, poly Rubber Co., Ltd. said that due to the continuous growth of market demand for poly rubber products, poly Rubber Co., Ltd. plans to build & ldquo; Expansion project of 23000 T / a hot melt adhesive of poly Rubber Co., Ltd. & rdquo;. On the basis of the original project capacity of 80000 tons per year, the new capacity of the project is 23000 tons per year, that is, the total capacity after expansion is 103000 tons per year.

It can be seen that the construction projects mentioned in the EIA Report & ldquo; Expansion project of 23000 T / a hot melt adhesive of poly Rubber Co., Ltd. & rdquo;, It is the construction project of poly Rubber Co., Ltd., and its total production capacity is 103000 tons per year after expansion.

It is worth noting that the north capital center of jinzhengyan combed the construction progress of the historical construction project of poly Rubber Co., Ltd. and found that there were or had construction projects & ldquo; Investment before inspection & rdquo; The situation.

According to the EIA report, poly glue Co., Ltd. rents the built plant located in building A1, No. 20, Lixin Sixth Road, Xiancun Town, Zengcheng District, Guangzhou to engage in the production of hot-melt pressure-sensitive adhesive (hereinafter referred to as "hot-melt adhesive"). Poly Rubber Co., Ltd. obtained the reply to the environmental impact report form of poly Rubber Co., Ltd. 8000 T / a hot melt adhesive construction project in April 2016 (Zeng EIA (2016) No. 45), & ldquo; 8000 T / a hot melt adhesive construction project & rdquo; It passed the acceptance of Guangzhou Zengcheng District Environmental Protection Bureau in September 2016, and the acceptance document number is zenghgyy [2016] No. 47.

Later, in order to meet the market demand, poly Rubber Co., Ltd. invested 17 million yuan in 2017 to expand the production capacity, increase the production capacity of 72000 tons of hot melt adhesive, and achieve an annual output of 80000 tons of hot melt adhesive. In December 2017, poly Rubber Co., Ltd. entrusted Tianjin Tianyuan Environmental Protection Agency Center Co., Ltd. to prepare and complete the environmental impact report form of poly Rubber Co., Ltd. annual 72000 tons of hot melt adhesive expansion project, and obtained the reply of Guangzhou Zengcheng District Environmental Protection Zone on the environmental impact report form of poly rubber Co., Ltd. annual 72000 tons of hot melt adhesive expansion project (Zeng Huan Ping [2018] No. 40) in April 2018. The expansion project & ldquo; 72000 T / a hot melt adhesive expansion project & rdquo; It passed the independent completion environmental protection acceptance on December 30, 2019.

That is, on December 30, 2019, the expansion project & ldquo; 72000 T / a hot melt adhesive expansion project & rdquo; After passing the independent completion and environmental protection acceptance, poly Rubber Co., Ltd. has achieved an annual output of 80000 tons of hot melt adhesive. Prior to this, the annual output of hot melt adhesive of poly Rubber Co., Ltd. was 8000 tons.

It should be pointed out that the laws and regulations stipulate that the environmental protection facilities supporting the construction project can be put into production or use only after passing the acceptance; Those that have not been accepted or fail to pass the acceptance shall not be put into production or use.

According to Article 17 of the regulations on the administration of environmental protection of construction projects, after the completion of the construction project for which the environmental impact report and environmental impact report form are prepared, the construction unit shall accept the supporting environmental protection facilities and prepare the acceptance report in accordance with the standards and procedures prescribed by the competent administrative department of environmental protection under the State Council.

Article 19 of the regulations on the administration of environmental protection of construction projects stipulates that construction projects that prepare environmental impact reports and environmental impact report forms can be put into production or use only after the supporting environmental protection facilities have passed the acceptance; Those that have not been accepted or fail to pass the acceptance shall not be put into production or use.

From the above situation, the historical expansion project of poly Rubber Co., Ltd. & ldquo; 72000 T / a hot melt adhesive expansion project & rdquo; The acceptance time of is December 30, 2019. Disclose according to the EIA Report & ldquo; In 2017, the company invested 70000 tons of melt glue to expand the annual production capacity of melt glue; That is, before December 30, 2019, the total capacity of hot melt adhesive of poly Rubber Co., Ltd. may be 8000 tons per year. However, the February prospectus and prospectus disclosed that from 2018 to 2019, the total production capacity of hot melt adhesive products of poly glue Co., Ltd. was 60000 tons and 66700 tons respectively, and the total output was 39600 tons and 53200 tons respectively; More than 8000 tons per year. In this regard, does the total capacity in 2018 disclosed in the prospectus of polyglue include the capacity of the historical construction project? Whether its historical construction projects exist & ldquo; Investment before inspection & rdquo; Suspected?

“ Break through & rdquo; How many investors can the poly glue shares of gem win & ldquo; Applause;? To be tested.

Comment(0)

You can comment after

SIGN IN