"It was the last time that such a strong subsidy and anti-routine promotion was the last time."

Recently, various e-commerce platforms have successively released the rhythm and gameplay of the 618 promotion. Different from the previous e-commerce promotions, which have been repeatedly criticized as "digital games", this time the platforms and merchants can be described as returning to the basics, and the promotion efforts are unprecedented in history.

On May 10, Tmall announced that the cross-store full discount rule during the 618 period will be adjusted to "300-50 full", and at the same time, the full reduction investment needs to be borne by merchants, and it will be on the hot search as soon as it is announced. In addition, Tmall no longer sets a minimum discount threshold of 10% off. Merchants who sign up for Tmall 618 should agree to voluntarily provide all-store merchandise to support the activity rules of "cross-store full discount" and "seller's version of freight insurance". During the event, Tmall 618 will distribute 10 billion consumer coupons and subsidies.

The 618 policies of other platforms are no exception, optimizing rules for common industry difficulties, increasing subsidies, and stimulating consumption as much as possible. For example, JD.com has launched 30 "three reductions and three excellent" business support measures, namely "reducing costs, reducing assessments, reducing risks, optimizing rules, optimizing efficiency, and optimizing services".

To a certain extent, 618 bears the heavy responsibility of leveraging consumption growth under repeated epidemics, but can everyone show off a wave of beautiful results this year?

Not long ago, an article titled "Merchant Crash: Half of China Can't Ship! The article "How long will it take for e-commerce to "fall in the cold"?" has aroused emotional resonance among many practitioners. Either offices, factories, and logistics warehouses are in the epidemic area, or consumers are in the epidemic area, making merchants sigh that "no one can escape."

According to the data of Nint Rentuo, in 2022 Q1, on the e-commerce platforms dominated by Ali and JD.com, the online scale of maternal and infant related categories is 58.37 billion, a decrease of 2.5% compared with the same period last year, which is also the online consumption of maternal and infant in recent years. The first negative growth in Q1. Of course, compared with other long-tail products, baby food that just needs high frequency is more flexible, but compared with the double-digit growth rate of 28.3% and 38.6% in the same period in 2021 and 2020, the Q1 baby food in 2022 will also be more flexible. For the first time, there was a slight increase of 3.8%.

For merchants such as children's clothing and children's shoes, due to the impact of the epidemic, many spring models have been directly turned into inventory, and this 618 is undoubtedly an opportunity for discount clearance. It also needs to grow, so this year there are fewer 618 routines and more subsidies.” Some merchants also said frankly, "We are all at a loss to earn traffic. In fact, it is a loss for stores to participate in cross-store full reduction activities. However, in order to compete with other similar merchants and support the traffic of the platform in the later stage, they will still actively respond to the platform's activities."

We have also heard some voices of "laying down". Some practitioners observed in the maternal and infant industry that they have not yet prepared for 618, and they will talk about it while they are alive. Recent survey data on the maternal and child industry shows that 92% of practitioners said that the impact of the epidemic on enterprises in 2022 will be greater than that in 2021; over 78% of surveyed enterprises said that their performance has declined from the beginning of the year to the present; 46% of practitioners are The future economic forecast is cautiously optimistic, while 40% of the user feedback is pessimistic or even extremely pessimistic.

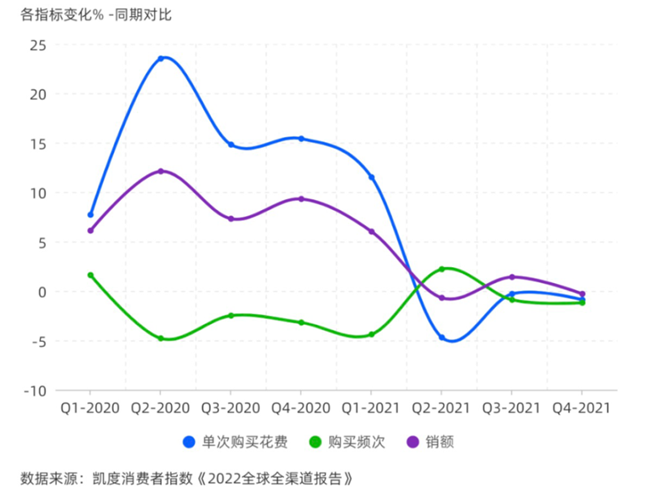

Under the shadow of the epidemic, the decline in consumption power has become an indisputable fact, and pessimistic expectations for the future have led many people to tighten their belts to live. According to Kantar Worldpanel data, starting from the second quarter of 2021, consumers' spending on a single purchase and the frequency of purchases have dropped significantly. If last year's Double Eleven was a watershed and officially entered an inflection point, then this year's 618 is difficult to make too much splash under the influence of various uncertain factors.

Of course, the trend of e-commerce promotion is only the tip of the iceberg that reflects the current status of the industry. Behind this, more and more companies are re-examining the companies themselves. After all, the more adversity is, the more the resilience and endogenous strength of the company will be tested. Rationally speaking, some of the current crises faced by many companies come from the epidemic, and some begin before the epidemic. Looking inward and continuing to improve, is not only necessary for survival at present, but also for market share and growth after the epidemic has passed. No matter what happens in 618 this year, I hope everyone can stick to it more resiliently.

Comment(0)

You can comment after

SIGN IN