In recent years, with the strong marketing power of mother and baby micro-businesses, many domestic diaper brands have emerged. Although these brands are often caught in huge controversies such as pyramid schemes, their charge has really fattened the generation of Haoyue Nursing and other generations. factory.

In China, the baby diapers that were originally cherished by mothers were all foreign brands such as Pampers (Procter & Gamble), Miaoershu (Kao), and Curiosity (Kimberly). In such an environment, reselling foreign brands of diapers can become a business.

In 2013, Ningbo Customs destroyed a company that smuggled Kao diapers, and the smuggled amount reached more than 570,000 packages, which exceeded the total value of imported baby diapers in Ningbo in 2012.

In the same year, at the auction site of the auction house entrusted by Ningbo Customs, a group of big men fought for more than 4,000 packs of Kao diapers, and the auction was temporarily suspended.

Men are so crazy about diapers because domestic mothers only recognize "Japanese original", and it is best to buy them directly from Japanese stores.

Under the domination of this concept, many people began to go to Japan as purchasing agents. In 2014, Japan arrested three Chinese men who were suspected of reselling diapers, and they would re-export the goods to China to sell at high prices.

So there is such a magical scene: in Japan, a country with such a low birth rate, the purchase of diapers is actually restricted.

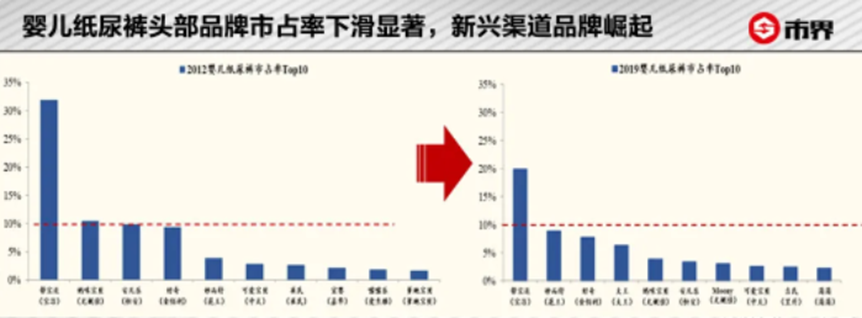

It is against this background that the domestic baby diaper market was once occupied by foreign brands. According to Euromonitor data, the top 5 domestic baby diaper brands Pampers (Procter & Gamble), Miaoershu (Kao), Curiosity (Kimberly), Goo.N (King), and Mummybaby (Unicharm) are all foreign brands. The total market share reached 59.7%.

If it continues to develop like this, the domestic baby diaper market may be completely occupied by foreign brands sooner or later.

Fortunately, domestic brands are very competitive. After 2012, with the rapid development of mobile Internet, in addition to e-commerce platforms, WeChat-based community e-commerce began to develop based on the logic of private domain traffic, breaking the traditional channel advantage of strong brands.

The fortunes of domestic diaper brands have turned a corner. The foundry represented by Haoyue Nursing started from this time and had the opportunity to show its strength.

The founder of Haoyue Care, Li Zhibiao, is a Zhejiang Jinhua. He used to do handicraft wholesale business in Yiwu market. Before making diapers, he was a distributor of Unicharm and Johnson & Johnson hygiene products.

On the surface, Haoyue Care does not sell goods, but it is the one that supplies domestic brands such as Calderdale and BabyCare.

In this wave of channel dividends, it is the mother and baby micro-businesses who are charging for Kaier Dele, that is, mothers and pregnant women. As a group of people who just need it, the fighting power of the mothers in promoting diapers is not lost to the momentum of Chinese aunts to grab gold.

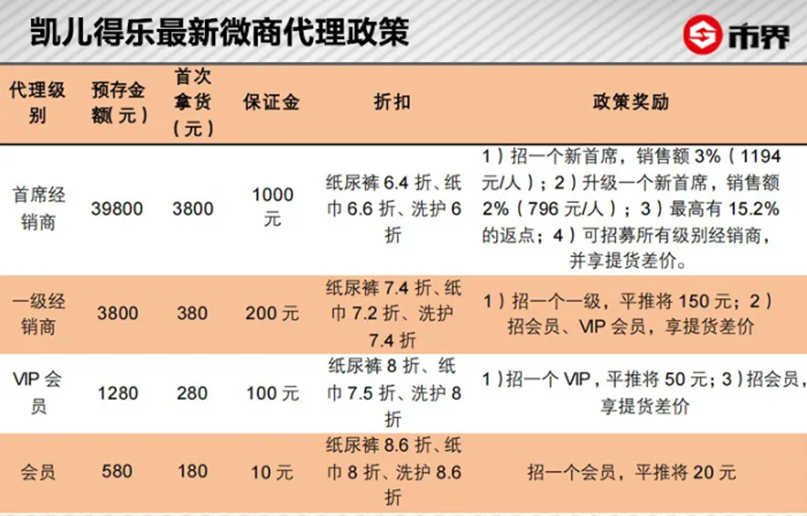

With the low cost of joining and the high expected return on investment, micro-businesses have natural magic power. Joiners can enjoy shopping discounts as long as they save a little money in advance; they can also earn rebates when they sell out, which is often referred to as "capital fees"; if they are fortunate enough to develop into a higher-level agent, they can get bigger discounts and higher rebate.

It is under such a vertical sales system that focuses on the Baoma group. From 2015 to 2017, Kaierdele, Miffy (Hangzhou Qianzhiya), Bainuoen (Wanbang Group), BEABA (Aiduo) were born. and other brands.

Taking Kaierdele as an example, although the company was only established in 2015, by 2019, the accumulated number of agent dealers (agents) reached more than 360,000, and the annual sales exceeded 3 billion (including non-diaper products).

With this wave of channel dividends, by 2019, although the domestic TOP5 baby diaper brands are still occupied by foreign brands, the market share has dropped to 46.5%.

In addition to channel dividends, the rise of domestic brands is also inseparable from the upgrading of Haoyue Nursing in product technology.

The core technology of diapers is the core. For a long time, diapers have mainly used wood pulp. In 2010, Haoyue Nursing developed a new wood-free multi-dimensional composite core structure.

It is the maturity of the composite core technology that makes the domestic diapers further light and thin, and the overall expansion after absorbing water, not easy to fracture, and the core does not become lumpy.

As soon as the new wood-free multi-dimensional composite core diapers were launched, they captured the hearts of mothers and became a great weapon for domestic brands to conquer cities and conquer territories.

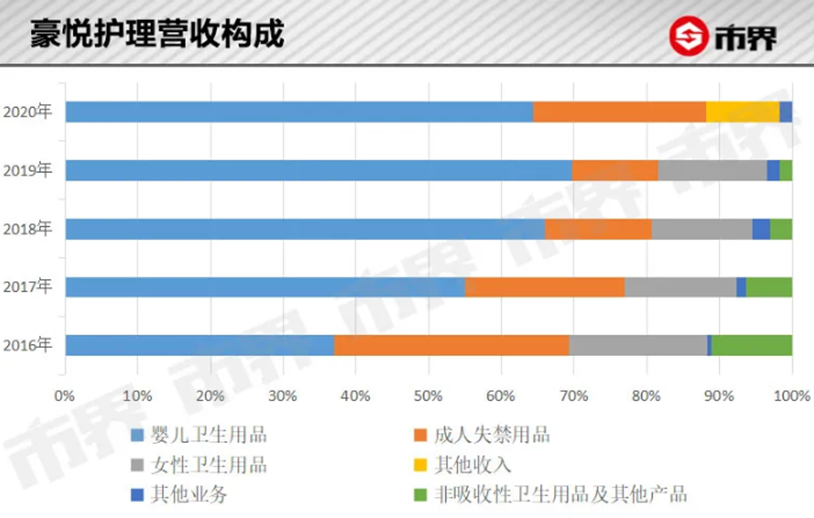

In addition, Haoyue Care does not limit its products to baby diapers, but also develops women's menstrual pants, adult diapers, nursing pads, etc.

In 2011, Haoyue Nursing developed a new type of sanitary napkin, women's menstrual trousers shaped like underwear, which can form a 360-degree full-envelope structure, which can replace night-use sanitary napkins, with stronger fit and water absorption.

In addition, in terms of price, each piece of menstrual pants is generally two or three dollars more expensive than night-use sanitary napkins. According to the research report of Essence Securities, based on the terminal price of 2.5 yuan/piece, the market space corresponding to women's menstrual pants is about 8.8 billion-16.3 billion yuan, and based on the ex-factory price of 1.3 yuan/piece, the market space corresponding to the ex-factory caliber is about 4.6 billion- 8.5 billion yuan.

For many years in a row, Haoyue Nursing's market share in the domestic menstrual pants market has exceeded 40%, which can be said to be unrivaled.

New technologies, new products, and Haoyue Nursing have successively invested two deep-water bombs in the market, superimposing the dividends of emerging channels such as e-commerce, micro-business, and mother and baby stores. The originally humble domestic personal care products suddenly attracted foreign brands. Attention, the domestic market is no longer their dominance.

Facing the rise of domestic brands, foreign brands are actually at a loss.

Due to supply chain, equipment and other reasons, they generally use a core with fluff pulp as the main raw material. To produce a composite core, it is necessary to replace the equipment; and women's menstrual pants, a product patent with potential market space, is not my own. Not to mention, when they are indecisive, domestic brands do not hesitate.

The first strike is strong, and the second strike suffers. In order to avoid further impact on the market, many multinational brands have begun to choose to cooperate with Haoyue Nursing, such as "Pampers Fresh Help", "Hushubao Koala Pants", "Sophie Super Sleeping Pants", "Gaojisi Night Pants", "Love" And ya good night pants" and so on.

With the help of channel advantages, new products and new technologies, Haoyue Nursing has achieved rapid development in performance. From 2016 to 2020, Haoyue Nursing achieved a total revenue of 7.2 billion yuan and a total net profit of 1.2 billion yuan, of which the net profit in 2020 alone reached 600 million yuan.

If the Li Zhibiao family directly holds 60.73% of the shares of Haoyue Nursing, the Li Zhibiao family will earn 360 million a year.

However, it cannot be ignored that the company has had insufficient production capacity for many years. Taking baby diapers as an example, from 2017 to 2019, its production capacity utilization rate exceeded 100%. The company is clearly aware of the problem and has added new production lines.

According to the forecast of Southwest Securities, as the expansion project is completed and put into operation, the production scale of various categories will gradually increase.

However, the company itself does have some potential risks.

Splitting the company's revenue structure found that the company's largest source of revenue is baby hygiene products, accounting for nearly 70%.

According to the China Paper Yearbook data, the market penetration rate of baby hygiene products in my country was only 2.1% in 2000, and it reached 63.9% in 2018, an astonishing growth rate. However, compared with the penetration rate of over 90% in developed countries, there is still room for development. At the same time, from 2017 to 2020, the number of births in my country has dropped for four consecutive years.

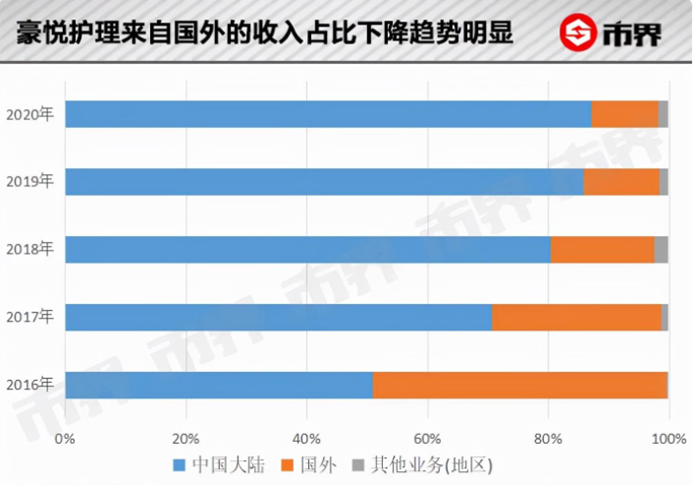

Although Haoyue Nursing's business has expanded abroad, the proportion of its revenue from foreign countries is on a downward trend, from 48% in 2016 to 11% in 2020.

In other words, the company's growth is mainly dependent on the domestic market. Then, the baby diaper business, which is the main source of revenue, is very important. Presumably, in the future, the company's performance growth will depend more on structural upgrades and penetration improvements, as well as on products such as menstrual pants and adult diapers.

However, Haoyue Nursing said in replying to the city community that in the long run, the state's encouragement of three-children will have a certain stimulating effect on the market environment, but the three-child policy is a long-term policy, and the market effect will not be particularly obvious in the short term.

In addition, the epidemic factor also has an impact on the company. Zhu Yue, a partner of CIC Consulting, told the city that the doubled increase in freight costs for voyage logistics and the depreciation of the US dollar caused by the epidemic had a negative impact on the export business. Since overseas OEM is a relatively important part of Haoyue's business, this negative impact is also detrimental to Haoyue.

But for Hao Yue Nursing, the biggest challenge doesn't stop there.

At present, Haoyue Nursing is taking the ODM+OBM route. To put it simply, ODM has its own technology, but will OEM production for customers; OBM uses its own technology, produces its own products, and affixes its own brand.

Although the company began to deploy its own brand very early, and the company has genes in category design, manufacturing, and brand building, at least from the current point of view, its own brand has not become bigger.

If the business is split, the company's ODM sales revenue has risen from 81.98% in 2017 to 91.59% in 2019. Although private label revenue is relatively stable, the proportion has been declining.

"The biggest challenge for ODM companies to develop their own brands is the lack of company marketing capabilities. As a manufacturer, ODM companies are far less capable of to C-end marketing than some brands." Zhu Yue told the city, "Breaking this balance requires A certain investment of time and money.”

ODM is the result of the refined division of labor in the industry. The advantages of ODM cannot be ignored. As long as the demand is strong, there is no need to worry about no orders and no need to worry about sales.

Once market demand declines and orders are limited, foundries may lower prices at the expense of profits in order to compete for orders.

This is why Shenzhou International and Huali Group, which are both foundries, are willing to spend time and energy on building their own brands. "Private brand is an important way to help companies increase profit margins and enrich sales channels." Zhu Yue said.

In other words, although the construction of own brand is a long-term and hard work, it has to be done.

Li Zhibiao obviously knew this too. On the one hand, he is proud that Haoyue Nursing has never been rejected by other brands because it has both its own brand and ODM. On the other hand, he has to admit that the biggest challenge of the company is the creation of its own brand. Haoyue Nursing also said when replying to the market that the company will increase its own brand building efforts, promote its own brand building with new retail in the future, and increase marketing investment at the same time.

Li Zhibiao has always been proud of Haoyue Nursing's R&D and innovation capabilities. After increasing investment in the future, can Haoyue Nursing's own brand become bigger and stronger?

Comment(0)

You can comment after

SIGN IN