During the epidemic, due to the increase in time at home, Feng Yunjun felt that the consumption of paper towels has increased significantly... Paper towels, as a daily necessity at home, are one of the items that many people stocked up during the epidemic. If the old irons think that household paper companies will make a lot of money during the epidemic, they are wrong. Vinda International (03331.HK), Hengan International (01044.HK), Zhongshun Jierou (10.660, -0.15, -1.39%) (002511.SZ), Jinhongye Paper (Note: "Qingfeng" parent company, Not listed) is the four giants in the domestic household paper industry. Taking Vinda International and Hengan International listed on Hong Kong stocks as examples, Fengyun Jun will take you to see how the household paper giants performed during the epidemic?

Hengan International and Vinda International, with annual revenue of more than 10 billion yuan, are the top two giants in the domestic tissue paper industry, far exceeding other competitors such as Zhongshun Jierou.

In 2021, Hengan International's revenue is 20.8 billion yuan, and Vinda International's revenue is 18.7 billion Hong Kong dollars (about 15.3 billion yuan).

The revenue impact of the pandemic on the two companies is diametrically opposed.

Since 2020, Hengan International's revenue has been declining, with a year-on-year decrease of 7.1% in 2021; Vinda International's revenue has been rising, with a year-on-year increase of 13.1% in 2021.

Therefore, the revenue gap between the two companies has narrowed significantly compared with before the epidemic.

In terms of profitability, the net profit of both companies in 2020 is considerable, but the situation has reversed in 2021.

In 2021, Hengan International's net profit was 3.3 billion yuan, a year-on-year decrease of 28.6%; Vinda International's net profit was 1.6 billion yuan, a year-on-year decrease of 12.6%.

In 2021, the net profit margins of Hengan International and Vinda International will be 15.8% and 8.8%, down 4.8 and 2.6 percentage points year-on-year, respectively.

Entering 2022, the profit situation is still not optimistic.

According to the latest disclosure of Vinda International, in the first quarter of 2022, revenue increased by only 2.2% year-on-year to HK$4.6 billion (approximately RMB 3.8 billion), no longer the high growth rate of the same period last year; net profit dropped by 37.8% year-on-year to 340 million Hong Kong dollar; net profit margin fell 4.9 percentage points year-on-year to 7.5%.

In short, from 2021 to the present, the life of the two major tissue paper giants has not been easy: Hengan International's revenue and net profit have both declined; Vinda International has increased revenue but not profit.

Why is this happening?

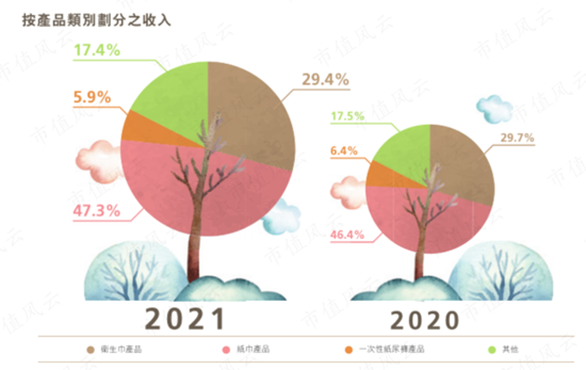

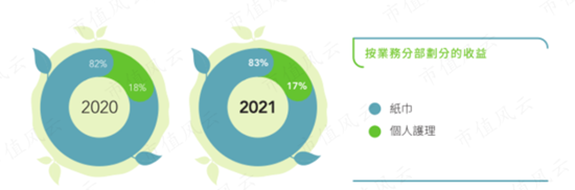

In 2021, the top three segmented products in Hengan International's revenue structure are: paper towels (47.3%), sanitary napkins (29.4%), and disposable diapers (5.9%).

In contrast, Vinda International's revenue structure is more simple, mainly paper towels. In 2021, tissue and personal care will account for 83% and 17% of revenue, respectively.

During the epidemic, the demand for household paper products continued to be strong, but the revenue of Hengan International's various businesses declined.

Among them, the revenue of paper towels fell by 5.2% year-on-year to 9.8 billion yuan; the revenue of sanitary napkins fell by 8.1% year-on-year to 6.1 billion yuan; the revenue of disposable diapers fell by 14.5% year-on-year to 1.2 billion yuan.

One of the reasons for the decline in Hengan International's tissue revenue was the decline in prices.

Paper towels are a fully competitive market with a high degree of product homogeneity. In recent years, major brand manufacturers have often reduced prices to maintain and seize market share.

In addition, during the epidemic, consumers have become more sensitive to the price of daily necessities, increasing the pricing pressure on manufacturers.

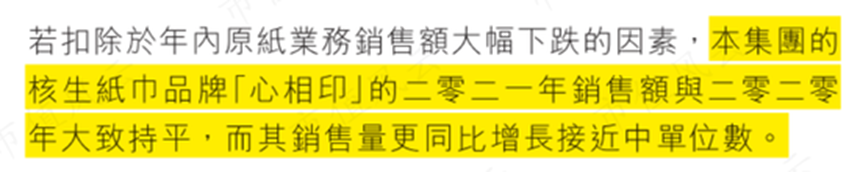

"Xinxiangyin" is the core brand of Hengan International's tissue business. According to reports, the sales volume of "Xinxiangyin" in 2021 will increase by mid-single digits year-on-year, but the sales will be flat with the same period last year, confirming the price reduction promotion.

Fengyunjun believes that the obstruction of sales channels is the main reason for the poor performance of Hengan International since the epidemic.

The epidemic has promoted the diversification of retail sales channels, especially as people stay at home for a long time, traditional offline sales channels have been hit, and consumers are increasingly turning to new retail channels such as e-commerce.

However, Hengan International has made slow progress in promoting the diversification of sales channels in recent years, especially in laying out an e-commerce channel network. Therefore, dragging down its performance during the epidemic can be described as "self-suffering."

The proportion of Hengan International's e-commerce revenue will not exceed 20% until 2021, reaching 23.1%, an increase of 4 percentage points from the same period last year. In 2020, the proportion of its e-commerce revenue even declined slightly.

In contrast, Vinda International has always attached great importance to e-commerce channels. The proportion of its e-commerce revenue was nearly 10 percentage points higher than that of Hengan International before the epidemic, and continued to increase during the epidemic, reaching 40.8% in 2021. .

Thanks to e-commerce channels, Vinda International maintained continuous business growth during the epidemic.

In 2021, Vinda International's tissue business revenue will increase by 13.9% year-on-year to HK$15.5 billion; personal care business revenue will increase by 9.3% year-on-year to HK$3.2 billion.

In the past, thanks to its diversified product portfolio, especially the sanitary napkin business with a very high gross profit margin, Hengan International had a clear advantage over its peers in terms of profitability.

During the epidemic, the gap in gross profit margin between Hengan International and Vinda International narrowed further.

In 2021, the gross profit margins of Hengan International and Vinda International will be 37.4% and 35.3%, respectively, with the gap narrowing to 2.1 percentage points.

Both companies' gross profit margins have continued to decline since 2020, but Hengan International's decline was higher than that of Vinda International.

In 2021, the gross profit margin of Hengan International's tissue business will fall back to a range below 30%; the gross profit margin will be 26.4%, a year-on-year decrease of 7.1 percentage points.

The reason for the decline in the gross profit margin of paper towels is that the price of wood pulp, the main raw material, has remained high since 2021.

As mentioned above, competition in the tissue market is incentivized, so it is difficult for most manufacturers to pass on the rising cost pressure to consumers.

Vinda International will also see a decline in the gross profit margin of paper towels and the overall gross profit margin in 2021 due to the increase in wood pulp prices. In the current period, Vinda International's gross profit margin of tissue paper was 35.4%, down 2.9 percentage points year-on-year.

Vinda International's gross profit margin declined even more because its tissue paper products were positioned at a higher end, and the gross profit margin of paper towels was also higher than that of Hengan International for a long time, which buffered the adverse effects of rising costs to a certain extent.

Slow inventory turnover can "beautify" the income statement?

The epidemic has adversely affected the capital turnover of the two companies.

Both companies have longer cash cycles than before the pandemic. In 2021, the cash cycle of Hengan International and Vinda International will be 107 days and 19 days, respectively.

Before the epidemic, Vinda International's cash cycle was negative, which means that it does not need to advance its own funds in the process of purchasing, production and sales, and its operating efficiency is quite high.

During the epidemic, the inventory turnover days of the two companies have changed significantly.

In 2021, the inventory turnover days of Hengan International and Vinda International will be 119 days and 139 days respectively, which are significantly longer than before the epidemic. The reason is that the supply chain is blocked and companies have increased inventory reserves to ensure sales.

In addition, the inventory turnover days of Vinda International were shorter than that of Hengan International before the epidemic, but were significantly longer during the epidemic.

Usually, shorter inventory turnover days means more efficient operating efficiency, but during periods of sharp rise in costs, slower inventory turnover speeds can "beautify" the current income statement.

The inventory of household paper enterprises is mainly composed of raw materials, mainly wood pulp.

When wood pulp prices continue to rise, slower inventory turnover means that companies still hold lower-cost wood pulp inventories most of the time, so raw material price increases have less impact on profitability in the early stage.

However, as the inventory of low-priced wood pulp is exhausted, the cost pressure caused by the soaring wood pulp price will be fully reflected in the subsequent production costs.

This is also the reason why Vinda International's gross profit margin will decline slightly in 2021, but will drop significantly in the first quarter of 2022.

During the epidemic, in response to uncertain business risks, the scale of Hengan International's interest-bearing liabilities decreased.

The gearing ratios of the two companies continued to decline. As of the end of 2021, the asset-liability ratios of Hengan International and Vinda International were 54.4% and 46.2%, respectively.

Comment(0)

You can comment after

SIGN IN