The repeated epidemics, the intermittent shutdown of supply chains and logistics, the beginning of 2022 is a bit of a stunned feeling of dreaming back to 2020, but life has to continue.

In the process of communicating with practitioners recently, many mother and baby merchants mentioned that while adjusting their expectations this year, Douyin and Kuaishou are still the incremental channels that are valued online. Of course, in an environment where traffic dividends and capital dividends disappear and industry competition intensifies, how to achieve refined operations and normalized sales on platforms such as Douyin, continue to ship and make profits, especially for new consumer brands, still has to be facing severe challenges.

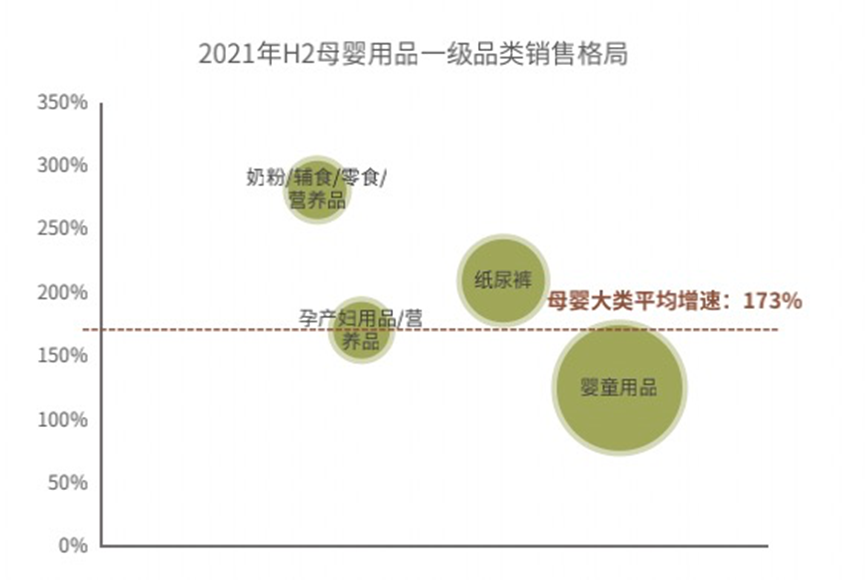

On the whole, baby products and diapers are currently the first-level categories with the highest proportion of sales in the mother and baby category on Douyin. In addition, the scale of baby food, including milk powder and nutritional products, is not very large, but the growth rate is high. Rapidly. According to the latest data from Cicada Mom, in March 2022, the estimated sales of baby products, diapers, maternity products/nutritional products, and baby food via live streaming on the Douyin platform are 430 million yuan, 310 million yuan, 230 million yuan, and 1.8 billion yuan, respectively. billion.

On the Douyin platform, in the fields of baby care, feeding, sleep and other baby products, baby bathing, skin care, and sunscreen products are the most concerned by consumers. Taking the data of March 2022 as an example, 5 of the top-selling TOP10 products are Related to baby care. In addition, brands such as Bedmei, Turtle Dad, Peiqin, i-baby, Daikesi, Rabbit Mom and other brands performed well. Among them, the monthly sales of Bedmei baby electric mosquito coils exceeded 17 million; the main products were children aged 3-12 The new brand, Turtle Dad, has a monthly sales of 31.9 million, of which children's physical sunscreen is very popular; the monthly sales of i-baby thermostatic sleeping bags exceed 10 million, and its customer unit price is significantly ahead of other top brands.

Judging from the characteristics of each star's single product delivery, brand self-broadcasting has gradually become the mainstream way of bringing goods, such as Turtle Dad's washing and care combination, Beiqin's bottle pacifier, and rabbit-head mother's selection of diapers and other products, all of which choose to use brand self-broadcasting to bring goods. . At the same time, there is a low degree of overlap in the types of star items among brands. In terms of product matching, combining items with the same usage scene into a product matrix is more conducive to the drainage of popular products, such as "cream + lipstick", "baby bottle" + pacifier + bottle pacifier care set" and so on. Earlier, some practitioners said that in the new stage, Douyin e-commerce will reduce or even cancel the subsidy for the flow of top people, and the focus will be shifted to the brand side, and it is the general trend to shift to products. At the same time, I have to admit that brand self-broadcasting is a test of brand power and the effect of live broadcast.

In addition, the wave of the epidemic that has lasted since the beginning of the year has had a huge impact on many businesses. The production capacity of factories has to be slowed down, and shipments and logistics in many places are also limited. In a recent interview with the media, Turtle Dad said that while thinking about the current solutions, such as using all the couriers that can be sent, and trying to retain the returns, he also thinks about the future, such as how to build after the wheel of performance slows down. Internal strength, how to optimize user satisfaction, how to manage internal collaboration and build its own barriers, as well as the persistence of research and development and new product development.

In the past two years, the differentiation and development of baby food categories has become particularly obvious, and Douyin has become a marketing field and sales field for many new and old brands. On the one hand, in the milk powder industry with a high degree of maturity and concentration, the growth of traditional online and offline channels has peaked, and some brands such as Feihe, Wyeth, and Aitamei have chosen Douyin as a major incremental business position. On the other hand, sub-categories such as supplementary snacks and nutritional products are still growing at a considerable rate online, and there are many new brands that are rapidly blossoming from Douyin, such as baby food supplements for infants and young children. Maternal and infant KOLs, parenting experts, and celebrities have cooperated to quickly open up the market and build brand awareness. In addition, Yingshi, which opened up a second outbreak with "graded feeding" in 2020, is also accelerating the deployment of multiple channels such as Douyin and Kuaishou.

Currently on Douyin e-commerce, brands such as Akita Manman, Yingshi, Yiya, Xiaopi, and Dr. Cheese rank high. Taking the Q4 data in 2021 as an example, Dr. Cheese’s sales are ahead of other brands, and the sales growth rate is high. Compared with the average value; nutritional products-related brands such as Jianminsi, Ole Milk, and Shi Bei'an performed well. For example, Jianminsi's sales in March 2022 were 13.83 million yuan, of which the sales of imported DHA in March was nearly 4 million yuan. Of course, compared with other categories, baby food still has huge room for improvement in Douyin.

From the perspective of the strategies of each brand, the star items of Akita Manman, Wo Xiaoya and Xiaopi all use self-broadcasting and delivery, while Jianminsi and Shi Bei'an drive sales with a matrix of massive talents. Among them, the star items of snacks are sold. Most of them are large-capacity packaging. At the same time, most baby food brands distribute products through differentiated prices to meet the needs of consumers of different minds. For example, the main products of Shi Bei'an and Ole Milk are both algal oil nutritional products, which has formed a clear pattern in terms of price positioning. Taking Q4 in 2021 as an example, the average unit price of Aule Milk is 359 yuan, while the average unit price of Shi Bei'an is 298 yuan.

"The size of diapers has shrunk from the original 60 billion to about 40 billion." Since last year, many practitioners have expressed the same view on the observation of the mother and baby industry. According to data from Nint Rentuo, in 2021, the sales of diapers on online platforms dominated by Tmall and JD.com will be 20.97 billion yuan, down 3.9% year-on-year, while the Douyin diapers category still maintains a relatively small size base. A good growth rate. For example, the average growth rate of this category in Q4 in 2021 is 58%.

What is more noteworthy is that the top diaper brands on Douyin are quite different from Tmall JD. column. In addition, big names in the industry such as Dawang, Curiosity, babycare, and Pampers are also continuously investing in the Douyin platform. As a category with more serious product homogeneity, the top brands of diapers have invariably reduced their self-broadcasting and delivery, and instead rely on the influence of top talents or a matrix of massive talents to promote single products.

From the price point of view, the price of the best-selling diapers on Douyin is mainly concentrated in 51-100 yuan. Among them, Dora Harley and Dr. Totoro are positioned in the high customer unit price range, and they are mainly sold in stockpiles; Brands such as Dian Taidi have also launched stocking items; star items are mostly in the 100-yuan range except stockpiling, and the price range is relatively concentrated.

Affected by multiple factors such as the decline in the birth population, the overall consumption of the maternity market has slowed down in the past two years. On mainstream online platforms, in 2021, the consumption of multiple sub-categories such as maternity clothing, maternity care, nursing bras, and maternity makeup will decline significantly, while breast pumps and maternal nutrition products will see a slight increase. Cicada's Q4 data in 2021 shows that among the TOP10 maternity brands, the sales growth rates of Catren, October Crystal, and aroom are all negative.

In addition, judging from the latest March data, the best-selling items in the Douyin maternity category are all from the head brands dominated by Manxi and Kangaroo Mother. At the same time, limited by the high promotion barriers of commodity types, most of the star items of maternity products brands are self-broadcasted.

Changes in the online market reflect the trend and development of the industry to a certain extent. Kantar Worldpanel shows that in 2021, sales of the overall infant and toddler category will drop by 2.7%, mainly due to the decline in the number of newborns, which will undoubtedly put more pressure on the industry this year. Under the circumstances that it is difficult to change the existing external environment, the only way out is to enhance the endogenous power of the enterprise and try its best to survive.

Comment(0)

You can comment after

SIGN IN