2021 is a bear period for the overall trend of the pulp market. According to the data as of November, the highest annual price of index contract appeared at the end of February, about 7627 yuan / ton; The lowest price appeared at 4750 yuan / ton at the end of October. Among them, from March to October, there was only a large increase in the price of pulp, and most of the rest of the time, it was either down or sideways. There is little room for the demand side to continue to shrink, and the pulp price can be regarded as the bottom at this stage. Meanwhile, the pressure on the supplier to remove the finished products from the warehouse will restrain the pulp price in the first half of 2022, and the operation focus in the second half of 2022 is expected to be improved.

01

The world's coniferous pulp has been in short supply for a long time, and the production plant operates at nearly full load.

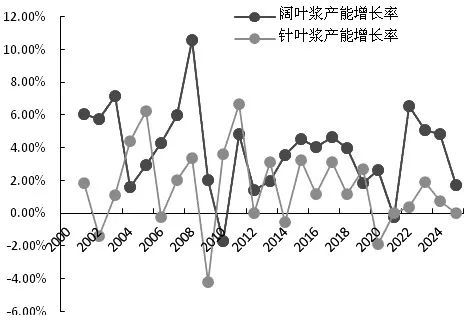

From 2020 to 2025, the global production of coniferous pulp is expected to remain stable, with an average annual growth rate of less than 1%. And 2022 is only 0.4% higher than 2021. To estimate the increase or decrease of supply, in addition to capacity, the operating rate should also be considered. In 2020, the operating rate of global coniferous pulp production has reached 91%. Analysts predict that with the natural growth of 2% - 3% in demand in the future, the operating rate of cork pulp plant will rise, close to 92% by 2022. The supply of coniferous pulp cannot be greatly increased without increasing the equipment and the old equipment close to full production.

In the commercial pulp market, broad-leaved pulp is the main contributor. There will be differences in the absolute number of statistics in different caliber, but it is certain that the three new equipment will be put into production from the end of 2021 to the middle of 2022. The mapa units of Brazil's bracell company and Chile's Arauco company, which are planned to be put into operation at the end of 2021, have a total production capacity of 4.1 million tons. In the middle of 2022, UPM also plans to build a 2.1 million ton UPM plant in Uruguay. Therefore, in 2022, the supply of broad-leaved pulp will increase significantly. In addition, by 2025, the output of broad-leaved pulp will increase by 19% compared with 2020. The capacity growth from 2022 to 2023 is expected to be 6% and 5%.

The production capacity of coniferous pulp and broad-leaved pulp increased worldwide

02

Phased supply increment will be formed at the beginning of 2022.

The transportation volume and speed of pulp will also affect the speed of supply. The export volume of coniferous pulp is mainly affected by the following two aspects:

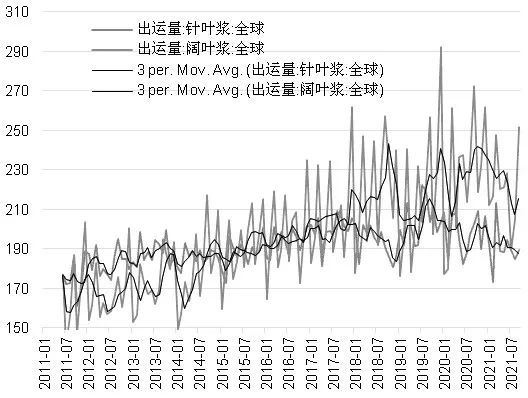

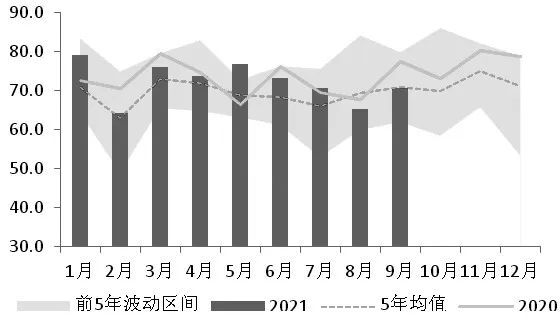

The first is the competition of broad-leaved pulp for transportation capacity. From 2017 to 2020, the global shipments of coniferous pulp and broad-leaved pulp showed the phenomenon of one change after another, and the two fluctuated in the opposite direction. This phenomenon changed in 2021, when the shipments of coniferous pulp and broad-leaved pulp decreased, mainly due to the decline of global shipping capacity. In the case of the decline of the total volume, the essence of the competition for transport capacity between the two has been ignored and covered up. It is predicted that there will be more new broad-leaved pulp production capacity in 2022, which requires strong logistics force. Regardless of whether the shipping capacity is restored or not, the growth of coniferous pulp shipment is limited.

Figure: global shipments of coniferous pulp and broad-leaved pulp

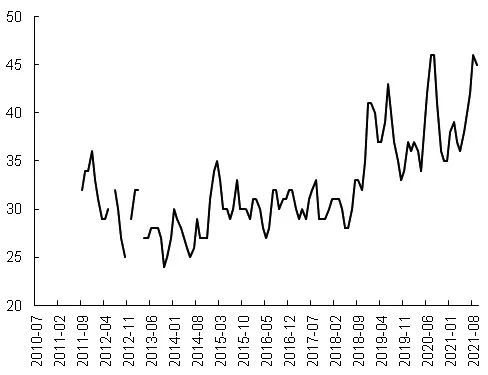

Second, the stock of coniferous pulp reached a peak. As of September 2021, the inventory days of global coniferous pulp manufacturers have reached 45 days, which is the highest record in the past 10 years. The release of unloading pressure of slurry factory must be accompanied by the phased increase of slurry output. Compared with the similar situation in August 2020, the shipment of coniferous pulp may rise marginally in 3 ~ 6 months. It can be expected that the supply of coniferous pulp will be released in early 2022.

Worldwide stock of coniferous pulp manufacturers

03

The proportion of domestic imports is relatively stable.

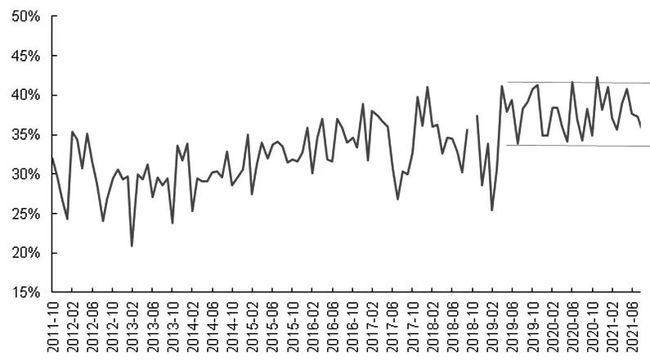

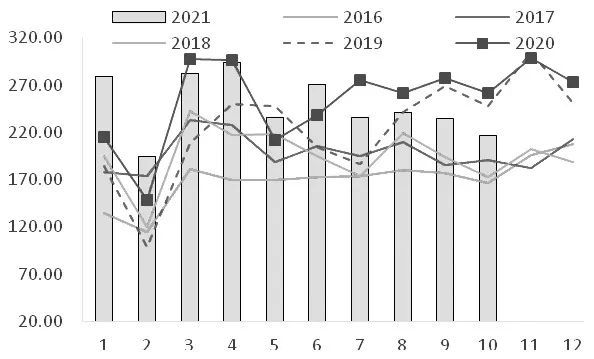

More than 90% of China's coniferous pulp depends on import. The amount of imports means the amount of current supply. China's pulp import fell in 2021. As of September, the import of coniferous pulp decreased by 0.8% year-on-year, and the import of broad-leaved pulp decreased by 3.9% year-on-year. Since this year, the total import volume of coniferous pulp and broad-leaved pulp has shown a trend of high before and low after.

Since 2019, the global export volume of coniferous pulp has decreased slowly, and the proportion of China's coniferous pulp import in the global export volume is relatively stable. It can be seen that there is no additional resource competition in China; The supply of coniferous pulp in China is basically synchronized with the world. Based on the above judgment on the shipment volume, the import of domestic coniferous pulp will increase by the beginning of 2022, but it will remain stable throughout the year.

Figure: the proportion of China's coniferous pulp imports in global shipments

Figure: import volume of domestic coniferous pulp

04

Expectations for 2022:

The rising price of toilet paper will only add icing on the cake to the pulp market, which is difficult to play a leading role. In the fourth quarter of 2021, the warehouse removal of toilet paper channel has been completed, which can be seen from the price trend in October. However, there is a serious surplus of industrial supplies, so it is difficult to continue the replenishment of inventory. The increase of the operating rate of the toilet paper factory is controlled by the price rise. Cultural paper production is dominated by small factories, and the increase of its operating rate will bring phased procurement. In the peak season and following the rise of raw material prices, it can partially support the demand for pulp, but this will not affect the market sentiment.

The production of white cardboard and whiteboard is more concentrated. When foreign waste can no longer enter the country, the price of domestic waste continues to rise, thus raising the cost of packaging paper. But don't worry too much, because the use of wood pulp in the field of packaging paper is small, and the change of packaging paper price needs to be transmitted to other white paper first, and then to pulp.

On the whole, after the prices of various kinds of paper fell for three consecutive quarters, the inventory of downstream channels is small, and the industrial inventory is mainly concentrated in the paper mill. Future inventory will be a bright spot on the demand side in 2022, and there is a high probability of opening in the second half of the year.

Figure: apparent consumption of imported wood pulp

Overall, on the supply side, the global production of coniferous pulp is basically stable. Although it increased slightly in 2022, it is still small on the whole. The pressure of market destocking in the first half of the year is greater than that in the second half of the year. In terms of demand, the sales will increase slightly in the first half of the year. The first half of the year is based on high inventory and low sales. The second half of the year will be driven by inventory and peak season. Based on the above analysis, it is estimated that the fluctuation range of pulp price in the first half of 2022 will be 4500-5200 yuan / ton, and the fluctuation range in the second half of 2022 will rise to 4800-5500 yuan / ton. There will also be some risk factors that can not be ignored, such as excessive global macroeconomic fluctuations, excessive maintenance and shutdown of coniferous pulp production enterprises, etc.

Comment(0)

You can comment after

SIGN IN